End-to-end ESOP solutions for startups, private firms, and listed companies

- ESOP Structuring

- Drafting Scheme & Grant Letter

- ESOP Implementation

- Valuation & Administration

ESOP design, compliance, valuation, and execution.

About Us

Affluence Advisory Private Limited is a leading ESOP advisory firm in India, offering end-to-end solutions for Employee Stock Ownership Plans (ESOPs) and other equity-based compensation strategies. With a strong focus on compliance, customization, and clarity, we help startups, private companies, and growing enterprises build ownership-driven cultures through well-structured and legally compliant ESOP plans.

CA Nimish Khakhar is a seasoned Chartered Accountant with more than 15 years of Experience in ESOP Advisory. He is a visiting faculty in various seminars organized by Institute of Chartered Accountants of India (ICAI).

Key Reasons for Implementing ESOPs

Attract, Reward, Motivate and Retain Employees

Enhances job satisfaction

Deferred compensation strategy

Good retirement benefit plan

Employees align with company’s goals

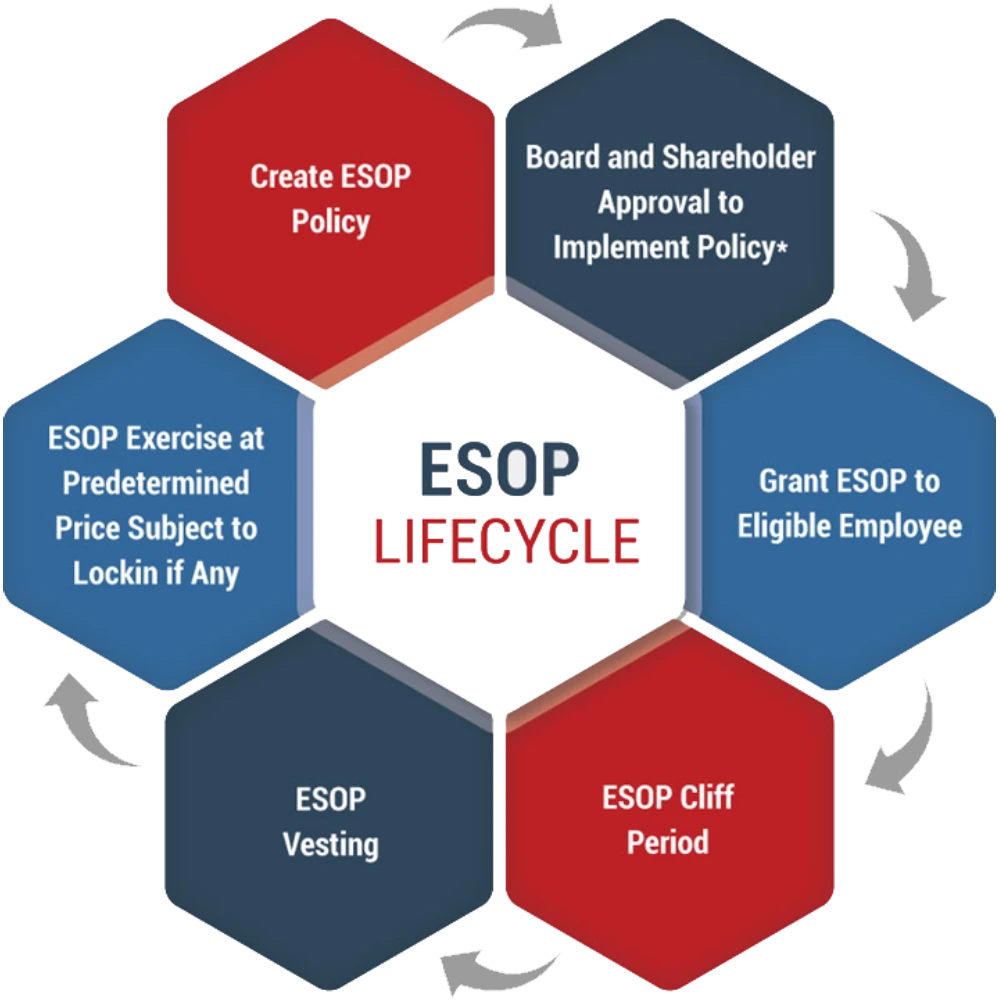

What is ESOP & Why ESOP?

Employee stock Options means a right but not an obligation given to an employee which gives such an employee a right to purchase or subscribe at a future date, the shares offered by the company, directly or indirectly, at a pre-determined price. Employee Stock Option Plans/Equity Incentive Plans (commonly referred to as ESOPs) are one of the most important tools to attract, encourage and retain Employees. It is the mechanism by which employees are compensated with increasing equity interests over time.

Key Reasons why Company implement

ESOPs are as under:

- Attract, Reward, Motivate and Retain Employees.

- Enhances job satisfaction.

- Deferred compensation strategy.

- Good retirement benefit plan.

- Employees align with company’s goals.

Key Terms used in ESOP:

- Grant: Offering of ESOP Options from Company to Employee. The company promises to give an employee a certain number of shares or options in the future, subject to conditions.

- Vesting:In very simple and general terms, vesting refers to the amount of time an employee must work before acquiring a certain benefit. When an employee is granted ESOPs, it means that he or she has the “right to purchase” the shares of the company subject to a certain timeline or criteria being met – this is referred to as “vesting” or “vesting frequency”.Vesting is therefore the process by which an employee becomes eligible to exercise his/her stock options and become a shareholder in the company.

- Exercise:In an Employee Stock Option Plan, exercise refers to the action an employee takes to buy the company’s shares that were previously granted to them under the ESOP.

What we provide

We appreciate their knowledge of Structuring the Scheme, SEBI regulations, Companies Act provisions, and Market Best practices in structuring ESOPs.

We particularly appreciate their ability to collaborate seamlessly with our internal teams and would recommend Affluence Advisory for exploring equity-based compensation strategies”

We appreciate their knowledge of Structuring the Scheme, SEBI regulations, Companies Act provisions, and Market Best practices in structuring ESOPs.

We particularly appreciate their ability to collaborate seamlessly with our internal teams and would recommend Affluence Advisory for exploring equity-based compensation strategies”

Meet our team members

Nimish Khakhar

CA

He is a fellow member of the Institute of Chartered Accountants of India. He has over 23 years of experience in Transaction (M &A) and Transaction Support Services (Vendor and Buyer side Due Diligence). His Portfolio includes both Brick and Mortar and Modern Trade Businesses. He has played key roles in a few large M & A transactions and is also been actively involved in advising Unicorns since the commencement of operations.

Bhavesh Chheda

CS

He is an associate member of the Institute of Company Secretaries of India. He has experience of more than 10 years and specializes in the areas of Listing Compliance, SME & Mainboard IPO, Preferential Issues, Capital Structuring in Listed Companies, SEBI Intermediary Registration & Compliances, ESOP, Mergers & Amalgamations, Implementation of Resolution Plans after NCLT Approval, and other related matters. He also provides guidance and support to the compliance team in respect of Companies Act / RBI / FEMA / Corporate law.

Payal Gada

CA

She is a fellow member of the Institute of Chartered Accountants of India and has 18 years of post-qualification experience. She is a registered valuer with IBBI as Valuation Professional and for the last 8 years, she is working on financial modeling and fair value analysis across different industries for diverse purposes, including regulatory/compliance, investment, and financial reporting. Fair valuation across asset classes including but not limited to business valuation, intangible, ESOPs, convertible instruments, and other complex instruments.